ZipBooks Overview & 2026 Industry Position

ZipBooks is a fast-growing accounting software platform tailored for freelancers, small business owners, and service professionals who seek a simplified yet comprehensive approach to bookkeeping. Since its inception, ZipBooks has earned a loyal following by focusing on intelligent design, automation of repetitive tasks, and accessible pricing. In 2026, ZipBooks stands as a serious contender in the cloud accounting space—bridging the gap between simplicity and power through automation, smart tagging, and AI-powered financial insights. As more business owners embrace digital finance tools, ZipBooks continues to be a well-aligned choice for managing cash flow, invoicing, reporting, time tracking, and banking—all under one intuitive dashboard.

From Launch to 2026: ZipBooks’s Journey

Founded in 2015, ZipBooks began as a free invoicing and accounting tool focused on helping entrepreneurs streamline their finances. The platform quickly attracted positive attention for its clean interface and affordable model.

- 2015: ZipBooks launches; offers free invoicing with unlimited clients.

- 2017: Adds time tracking, advanced category tagging, and smarter transaction classification.

- 2019: Introduces machine learning-assisted categorization and real-time feedback scoring.

- 2021: Launches “Smart Insights” for improved reporting and business health metrics.

- 2023: Adds built-in payment integrations and automated workflows.

- 2025: Integrates more deeply with CRM, banking, and payroll tools to create a financial OS for small business.

Looking ahead, ZipBooks’s 2026 strategy centers on data-driven automation, smart financial benchmarking, and modular API-friendly deployments for growing businesses.

ZipBooks Key Features

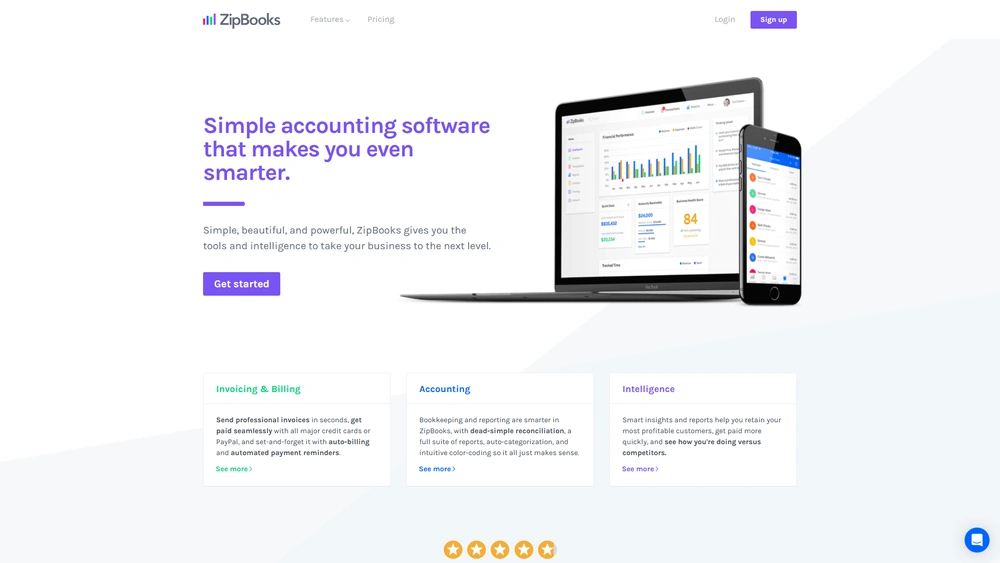

ZipBooks’s feature set is expansive yet beginner-friendly, offering the right combination of automation, flexibility, and control. Here’s what makes it stand out in 2026:

- Smart Invoicing: Customizable templates, recurring invoices, and auto-reminders.

- Bank Reconciliation: Seamless syncing with thousands of banks for quick reconciles.

- AI-Powered Categorization: Machine learning suggests correct tags for transactions.

- Time & Project Tracking: Collaborate, log time, and assign billable hours by project.

- Financial Health Score: Real-time snapshot of business performance based on market benchmarks.

- Expense Management: Effortless receipt attaching and team-level spending control.

- Client Intelligence: Automatically ranks your best clients based on payment behavior and profitability.

Workflow & UX

ZipBooks’s interface continues to earn high marks for navigation, clarity, and speed. The left-hand menu offers quick access to Projects, Transactions, Invoices, and Reports. Whether creating a project, tagging expenses, or issuing a recurring invoice, the process is streamlined in just a few clicks. The minimal visual design reduces cognitive load while maintaining the functionality you’d expect from premium platforms. For mobile-first users, the mobile app is responsive, fast, and supports nearly all core features.

ZipBooks Pricing Analysis & Value Metrics

As of July 2026, ZipBooks keeps pricing competitive and transparent, with four core tiers:

| Plan | Monthly Rate | Key Features |

|---|---|---|

| Free | $0 | Unlimited invoicing, basic reports, 1 user |

| Smarter | $20 | Time tracking, bank sync, AI categorization |

| Team | $35 | Multiple users, role permissions, reporting tools |

| Accountant | $55 | Manage client books, accounting workflows, custom branding |

Overall, ZipBooks offers tremendous value for freelancers and agencies looking to scale without switching systems.

Competitive Landscape

ZipBooks primarily competes with QuickBooks, FreshBooks, Wave, and Xero. Here’s how it compares:

| Platform | Best For | Starting Price | Standout Feature |

|---|---|---|---|

| ZipBooks | Freelancers & small teams | $0 | AI-enhanced categorization & Health Score |

| QuickBooks | Accountants & growing SMBs | $30 | Robust reporting & integrations |

| FreshBooks | Service-based freelancers | $19 | Client collaboration & expense tracking |

| Xero | International SMBs | $15 | Multi-currency & bank feeds |

| Wave | Sole proprietors | $0 | Free invoicing & payments |

Use Cases

ZipBooks is especially strong in these user scenarios:

- Sole proprietors needing simple bookkeeping + invoice automation

- Remote agencies tracking time and projects in real time

- Freelancers needing health scores for client profitability

- Service businesses prioritizing bank integration and smart syncing

Integrations

ZipBooks offers native or Zapier-enabled integrations with tools like:

- Stripe, PayPal for payment collection

- Gusto & ADP for payroll syncing

- Slack, Trello for team collaboration

- CRM tools like Hubspot and Pipedrive via API

- Google Drive for receipt/image syncing

Its open API also encourages developers to embed accounting features within custom business apps.

Pro Tip: Use ZipBooks Smart Tags and AI-categorization together to automate up to 80% of your financial sorting tasks—critical for solopreneurs scaling quickly.

Pros & Cons

- Pros:

- Free plan offers generous features

- Intelligent transaction heuristics

- Health score and benchmarking tools

- Minimal learning curve and clean UX

- Cons:

- No full inventory system (yet)

- Less suited for international accounting standards (e.g., VAT support)

- Support mainly via email and chat

Final Thoughts

ZipBooks is a rock-solid option for independent pros, agencies, and service-based SMBs looking for faster, smarter accounting without overpaying. Its automation, machine learning enhancements, and financial insights make scalable finances achievable—even for those with no formal accounting training. While larger enterprises may want deeper integrations or inventory support, ZipBooks punches well above its weight in the small business arena.

ZipBooks FAQ

Yes. ZipBooks offers a completely free plan with unlimited invoicing and basic accounting tools. Great for freelancers or startups on a budget.

Yes, the Accountant tier allows access to manage multiple books and collaborate securely with professional accountants or bookkeeping teams.

While ZipBooks doesn’t include native payroll, it integrates seamlessly with payroll platforms like Gusto and ADP.

Yes. ZipBooks uses bank-level encryption and read-only bank connections to ensure your financial data remains protected and private.

ZipBooks focuses on simplicity, faster performance, and machine learning tools at a fraction of the price—ideal for solopreneurs and agencies, while QuickBooks suits high-volume, multi-tax enterprises.