Sage Intacct Overview & 2026 Industry Position

Sage Intacct is a cloud-native financial management platform designed for growing mid-sized businesses seeking agile, robust accounting operations without the burden of legacy systems. With flexible modules spanning core financials, advanced functionality, and deep industry customization, it has become the go-to choice for CFOs and controllers in 2026 who need scalable accounting infrastructure with deep integration capabilities.

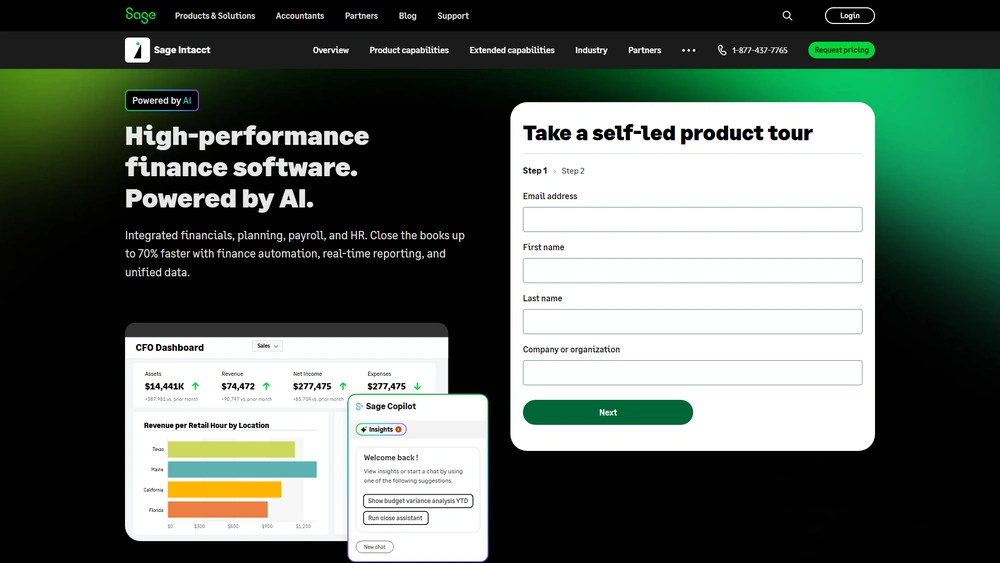

Positioned at the intersection of advanced automation and real-time reporting, Sage Intacct accelerates decision-making through AI-powered insights, a rich partner ecosystem, and user-first design. As regulatory complexity grows and businesses digitize downstream processes, Sage Intacct leads the shift to finance-led transformation.

From Launch to 2026: Sage Intacct’s Journey

Sage Intacct was founded in 1999 with a clear vision: to deliver powerful accounting solutions via the cloud. The goal was ambitious at a time when on-premise software still reigned. Over the years, Sage Intacct became a leader in cloud-based financial management, particularly after its acquisition by The Sage Group in 2017, which expanded its global footprint and resources.

- 2001: Launch of early cloud accounting modules for SMBs.

- 2009: Added multi-entity support and dimensional reporting.

- 2017: Acquired by Sage Group for $850M, fueling R&D.

- 2021: AI integrations begin—smart data captures, predictive analytics.

- 2023: Embedded vertical-specific features for nonprofit, SaaS, and healthcare sectors.

- 2025: Focus is on intelligent automation and ecosystem extensibility through APIs and Sage’s AI Copilot suite.

2026 strategy thesis: Transform the controller’s desk into a real-time decision center using cloud-first automation, embedded AI, and a vast third-party marketplace.

Sage Intacct Key Features

Sage Intacct delivers both breadth and depth in financial operations, powering agility across industries. Noteworthy capabilities for 2026 include:

- Core Financials: Multi-entity, multi-currency, AR/AP automation, dimensional GL.

- Revenue Recognition: ASC 606/IFRS 15-compliant billing and deferrals.

- AI Accounting Assistant: Automates journal entry suggestions, anomaly detection.

- Project Accounting: Cost tracking, time allocations, role-based budgeting.

- Nonprofit Toolkit: Grant tracking, fund accounting, donor transparency tools.

- Visibility Dashboards: Real-time and customizable reporting with drill-downs.

The standout innovation is its Intelligent General Ledger, which uses machine learning to speed up reconciliations and uncover discrepancies with minimal manual effort.

Workflow & UX

Sage Intacct boasts a clean, modular interface with logical navigation and a quick learning curve for non-technical financial users. Key aspects include:

- Drag-and-drop dashboard customizer for each role.

- Multi-layered approval workflows built-in, no scripting.

- Mobile app with limited AR/AP, invoice approvals, and reporting.

- SmartSearch bar that locates transactions by dimensions across entities.

The 2025 interface introduces a new AI Copilot overlay for interactive Q&A with general ledger and payables functions — making insights accessible through natural language prompts.

Sage Intacct Pricing Analysis & Value Metrics

As of July 2026, Sage Intacct pricing tiers are:

| Plan | Monthly Price | Best For | Key Features |

|---|---|---|---|

| Essentials | $800+ | Startups, Nonprofits | Core GL, AR/AP, dashboards, 1 entity |

| Growth | $1,500+ | Growing SMBs | Multi-entity, revenue recognition, budgeting |

| Enterprise | $3,000+ | Multi-subsidiary firms | All Growth features + project accounting, deep integrations |

Value Verdict: Compared to traditional ERPs, Sage Intacct delivers ROI through lower operational costs, better compliance, and faster reporting, especially for firms with cross-entity or multi-vertical needs.

Competitive Landscape

| Platform | Strengths | Weakness | Ideal User |

|---|---|---|---|

| Sage Intacct | Flexible GL, cloud-native, strong APIs | Higher learning curve | SMBs to Enterprises |

| NetSuite | All-in-one ERP | Rigid licensing, pricier | Mid-market to large |

| QuickBooks Online Advanced | Easy to use, affordable | Limited scaling/complexity | Simpler businesses |

| Xero | Modern UX, great integrations | Less suitable for multi-entity | Solo & SMB |

Use Cases

Sage Intacct thrives in industries with compliance complexity, decentralized decision-making, or dynamic forecasting needs:

- Nonprofits: Grant tracking, fund splits, donor reporting.

- SaaS/Tech: Deferred revenue, subscription analytics, usage-based billing.

- Healthcare: Inventory/expenses across departments or facilities.

- Professional Services: Project cost management, time tracking.

Integrations & Ecosystem

Sage Intacct’s open API ecosystem integrates with over 300+ tools in 2026, spanning:

- Payroll/HR: Gusto, ADP, BambooHR

- CRM: Salesforce (deep, native), HubSpot

- E-commerce: Shopify, Stripe, BigCommerce

- Forecasting: Vena, Planful

Pro Tip: For custom workflows, leverage Sage Intacct’s no-code platform to build approvals across third-party systems—without developer involvement.

Pros & Cons

- Pros: Powerful GL, great visibility tools, flexible integrations, scalable for growth

- Cons: Initial configuration complexity, premium pricing for add-ons, limited built-in payroll

Final Thoughts

Sage Intacct is best suited for mature small businesses, multi-entity firms, and nonprofits seeking a long-term finance stack optimized for growth, transparency, and control. Budget-conscious startups may prefer lighter tools, but for finance teams ready to scale with confidence, it remains a leader in 2026.

Sage Intacct FAQ

While Sage Intacct supports startups, especially nonprofits, its most value comes at the Growth or Enterprise levels with automation and reporting scale.

Payroll is offered via integrations with third-party platforms like Gusto and ADP, not natively within Sage Intacct.

Nonprofits, SaaS, professional services, and healthcare organizations benefit most from its automation, dimensionality, and reporting engines.

Yes, it handles multi-currency, multi-entity, international tax compliance, and consolidations.

Sage Intacct excels in modularity and user-friendliness, while NetSuite offers a larger, complete ERP but requires heavier implementation and maintenance.