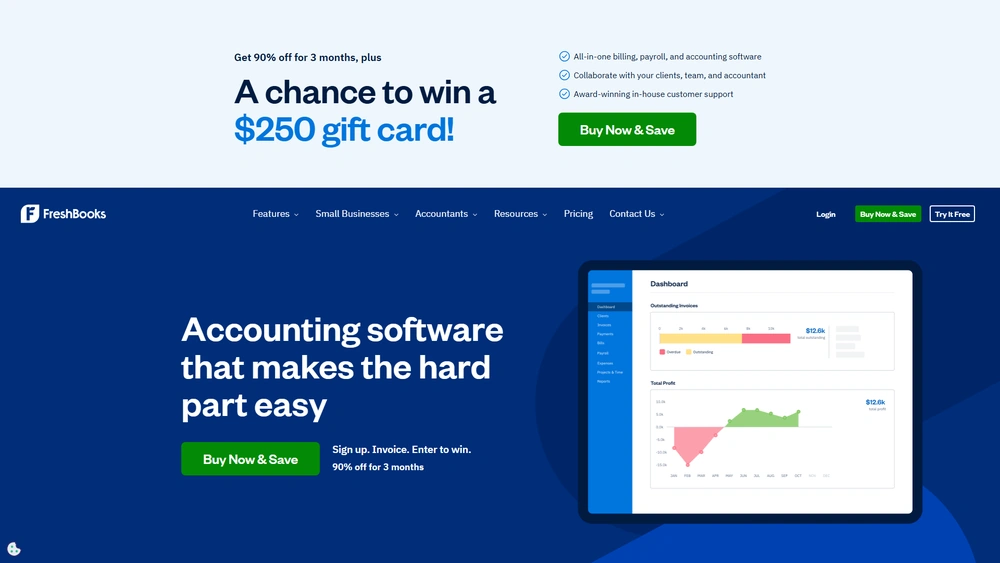

FreshBooks Overview & 2026 Industry Position

FreshBooks has established itself as a go-to cloud accounting solution for freelancers, consultants, and small business owners across over 160 countries. Known for its clean UI, seamless time tracking, and intuitive invoicing tools, FreshBooks empowers users to manage business finances with ease. In 2026, its relevance climbs even higher thanks to smart automation, AI-enhanced reporting, and seamless integration with broader fintech ecosystems. As more SMBs embrace digital-first financial ops, FreshBooks delivers a blend of simplicity and intelligence tailored to modern business needs.

From Launch to 2026: FreshBooks’s Journey

FreshBooks was born in 2003 after a billing error led the founder to code his own invoicing tool. Originally a time-tracking and invoice-focused app for freelancers, it quickly evolved into a full-scale accounting solution. In 2010, FreshBooks surpassed 2 million users. The 2016 redesign marked a pivotal shift to a true cloud platform. By 2019, it introduced double-entry accounting, making it suitable for expanding businesses. The 2021 launch of FreshBooks Select catered to larger teams. In 2023, predictive reports and mobile-first UX boosted adoption. Now in 2026, FreshBooks is focused on embedded fintech and automated cash flow forecasting — empowering users to work smarter, not harder.

FreshBooks Key Features

FreshBooks offers a well-rounded suite of features optimized for service-based businesses and freelancers:

- Custom Invoicing: Branded templates, recurring invoicing, and automatic payment reminders.

- Expense Tracking: Scan receipts, categorize expenses, link bank accounts.

- Time Tracking: Built-in timer, project time allocation, team-level tracking.

- Client Portal: Clients can approve estimates, pay invoices, and review their records transparently.

- Double-Entry Accounting: Full ledger capabilities, customizable chart of accounts, and accountant access.

- AI-Powered Insights: Forecasting, profit margin analysis, and real-time reporting (added in 2026).

- Mobile Optimization: Excellent mobile apps for iOS and Android with real-time syncing.

Workflow & UX

FreshBooks stands out for its ease of use. The modern interface presents key actions — like sending invoices or tracking time — within 1–2 clicks from the dashboard. Features are intelligently grouped and clearly labeled, reducing the learning curve. The minimalist design supports quick navigation, and real-time mobile syncing ensures consistent updates across devices. The client experience is equally smooth, with clear estimates, portal-based approvals, and seamless payment options.

FreshBooks Pricing Analysis & Value Metrics

Accurate as of July 2026, here’s a look at FreshBooks pricing tiers:

| Plan | Monthly Price | Ideal For | Core Features |

|---|---|---|---|

| Lite | $17/mo | Solopreneurs | 5 clients, invoices, expense tracking, estimates |

| Plus | $30/mo | Freelancers | 50 clients, recurring invoices, time tracking, proposals |

| Premium | $55/mo | Small Agencies | Unlimited clients, advanced reports, project profitability |

| Select | Custom | Scaling Businesses | Dedicated account manager, custom reports, team onboarding |

Value Assessment: FreshBooks delivers excellent ROI for service-focused businesses and consultants, especially at the Plus and Premium levels.

Competitive Landscape

| Brand | Ideal For | Key Differentiator | Starting Price |

|---|---|---|---|

| QuickBooks | Small to Mid Businesses | Inventory, payroll depth | $30/mo |

| Wave | Freelancers | Free plan | Free |

| Xero | International SMEs | Multi-currency support | $29/mo |

| FreshBooks | Service-based pros | UX & client portal | $17/mo |

FreshBooks Integrations

FreshBooks connects with over 100 tools, enhancing workflow, payroll, CRM, e-commerce, and payment systems. Noteworthy integrations include:

- Stripe – Accept online payments effortlessly

- Gusto – Payroll and benefits for small teams

- Shopify – E-commerce synchronization

- HubSpot – CRM and client lifecycle management

- Zapier – Automate repetitive tasks between apps

Key Use Cases

FreshBooks shines in service industries where project billing and time are critical. Common use cases include:

- Creative professionals (designers, writers, marketers)

- Consultants and coaches

- Legal and financial advisors

- Freelance developers and contractors

- Small agencies needing multiple user seats

Pros & Cons

- Pros:

- Clean UX ideal for non-accountants

- Best-in-class mobile app

- Client portal streamlines communication

- Secure cloud access

- Cons:

- Limited inventory management

- Pricey for larger teams at Premium level

- No native payroll (needs Gusto)

Final Thoughts

FreshBooks balances approachability with capability — perfect for creatives and consultants who value control without complexity. It’s competitively priced, feature-rich, and integrates with key tools. Businesses with more intense tax, SKU, or payroll needs may need add-ons or opt for more accountant-geared tools like QuickBooks Online. For its niche, FreshBooks Select offers scalability while Lite and Plus plans offer sleek simplicity.

Pro Tip: Pair FreshBooks with Gusto for a full-service finance+payroll stack that grows with your team.

FreshBooks Q & A

Yes, FreshBooks is known for user-friendliness. Its minimalist interface, guided setup, and mobile app make it very beginner-accessible.

Yes. FreshBooks includes accountant access granting your bookkeeper or tax pro full visibility into your ledgers and reports.

Absolutely. FreshBooks lets you add logos, set custom colors, adjust templates, and personalize messaging on all invoices and estimates.

Yes. As of July 2026, FreshBooks offers a 30-day free trial with access to most core features. No credit card required.

FreshBooks integrates natively with Stripe and PayPal for invoice payments, and also supports WePay and Apple Pay in select regions.