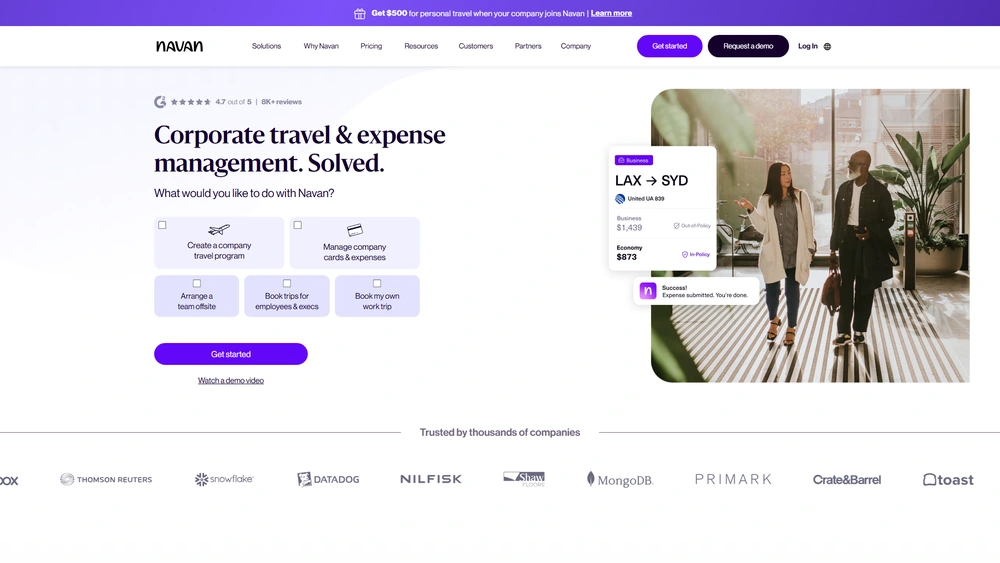

Navan Overview & 2026 Industry Position

Navan is an all-in-one travel, spend management, and expense platform designed for modern businesses. Since its inception, it has built a reputation as a category leader in automating complex corporate workflows through intuitive UX and real-time data visibility. As 2025 ushers in a wave of AI-driven operations and tighter cost controls, Navan’s integrated stack positions it at the forefront of B2B fintech-embedded automation. With hybrid workforces and global operations becoming the new normal, Navan’s unified ecosystem offers a strategic edge to enterprises balancing agility with compliance.

From Launch to 2026: Navan’s Journey

Founded in 2015 as TripActions, Navan originally focused on streamlining corporate travel booking. By 2019, it introduced Liquid, its spend management solution. In 2022, TripActions rebranded to Navan, combining NAVigation and Avant-garde to reflect its broader fintech vision.

- 2015: TripActions launches as a travel management platform.

- 2019: Introduces TripActions Liquid for spend control.

- 2021: Raises $275M, expands into expense management.

- 2022: Rebrands to Navan, signaling a platform shift.

- 2023: Launches dynamic real-time expense and payment analytics.

- 2024: Adds GenAI-powered travel and spend advisors.

Navan’s 2026 strategy centers on becoming the default fintech layer for enterprise travel and expense through intelligent automation, modular deployability, and embedded financial services.

Navan Key Features

Navan’s 2025 feature suite reflects a shift to full-stack finance + travel orchestration. Here’s what powers it:

- Travel Booking: AI-driven business travel platform with real-time fares, policy routing, and mobile support.

- Navan Expense: Smart scanning, instant approvals, automated expense categorization.

- Navan Cards: Physical/virtual corporate cards with spend controls, linked to budget owners and categories.

- AI-Powered Insights: Spend forecasting, anomalies, and carbon offset data in real time.

- Mobile-first UX: Employees manage trips, receipts, and approvals from a single mobile superapp.

Workflow & UX

Navan builds its user interface to eliminate friction from finance-adjacent workflows. Onboarding is minimal, mobile parity is full, and contextual prompts power 1-click actions.

- Navigation: Clean tabbed layout for Travel, Expenses, Cards, Reports, and Admin.

- User Prompts: Smart nudges remind users to upload receipts or flag spend discrepancies.

- Multi-language & Time Zones: Localized experience for international teams.

Pro Tip: Use Navan’s mobile app to scan receipts instantly — geo-tag makes reimbursements much faster for field teams.

Navan Pricing Analysis & Value Metrics

As of July 2026, Navan offers modular pricing based on organization size and selected tools:

| Tier | Price Range | Includes |

|---|---|---|

| Navan Travel | Free to $25/user/mo | Online booking + 24/7 agent; air/hotel integrations |

| Navan Expense | $10–$20/user/mo | OCR scanning, approvals, audits, card sync |

| Navan Complete | $25–$40/user/mo | Travel + Expense + Insights + Carbon tracking |

| Custom Enterprise | Volume-based | SSO, onboarding, concierge support, integrations |

Value Summary: Navan’s pricing is competitive versus standalone rivals when bundled; ROI accelerates for companies with >50 employees and monthly travel spend over $5K.

Competitive Landscape

| Platform | Focus | Best For | Avg. Price |

|---|---|---|---|

| Navan | Travel & Expense | Mid-large enterprises | $25–$35/user |

| Concur | Legacy ERP integration | Large, global firms | $40+/user |

| Ramp | Spend Management | Lean finance teams | Free–$15 |

| TravelPerk | Travel-only | SMBs + EU regions | $20–$30 |

Where Navan Expense and Navan Cards stand out is in combining real-time payments, mobile-first travel, and live policy enforcement without layering multiple vendors.

Use Cases

Navan works especially well for companies that:

- Operate frequent domestic/international travel programs

- Have hybrid workforces requiring card-based purchasing

- Need policy-driven controls across teams and workflows

- Are migrating away from siloed ERP or T&E tools

Integrations

Navan integrates with 100+ third-party tools across the SaaS and finance ecosystem:

- ERP: NetSuite, SAP, QuickBooks, Xero

- HRIS: BambooHR, Rippling, Workday

- Slack & Teams: Approve/reject via chat

- Gmail & Outlook: Receipt sync

- Payment Rails: Visa, Mastercard, ACH payout tools

Pros & Cons

- Pros:

- Unified spend + travel in one intuitive platform

- AI-based workflows reduce admin time

- Strong mobile app experience for travelers

- Multi-country support with compliance

- Cons:

- Learning curve for finance admins moving from legacy systems

- Premium tier may feel costly for startups

- Some advanced card rules only available at enterprise level

Final Thoughts

If your business involves complex travel, distributed teams, or growing spend oversight — Navan offers a robust and modern replacement for stitched-together expense systems. It excels in mid-market and enterprise tiers but can be modularly deployed based on company size. While it’s not the lowest cost option, the automation and visibility gains make it a strong investment for scaling teams prioritizing usability, compliance, and employee experience.

Navan FAQ

Yes. Navan’s Travel module offers a $0 plan with booking tools and policy enforcement for startups and small teams.

Yes. Navan supports multi-currency reimbursements and VAT compliance across 40+ countries.

Absolutely. Navan integrates with platforms like Workday, BambooHR, and Rippling for unified employee data handling.

Navan Complete combines travel bookings, expense automation, carbon tracking, and analytics into a full-stack experience.

Most teams onboard within 5–10 business days, with larger orgs receiving tailored training and ERP migrations.