Sage Business Cloud Overview & 2026 Industry Position

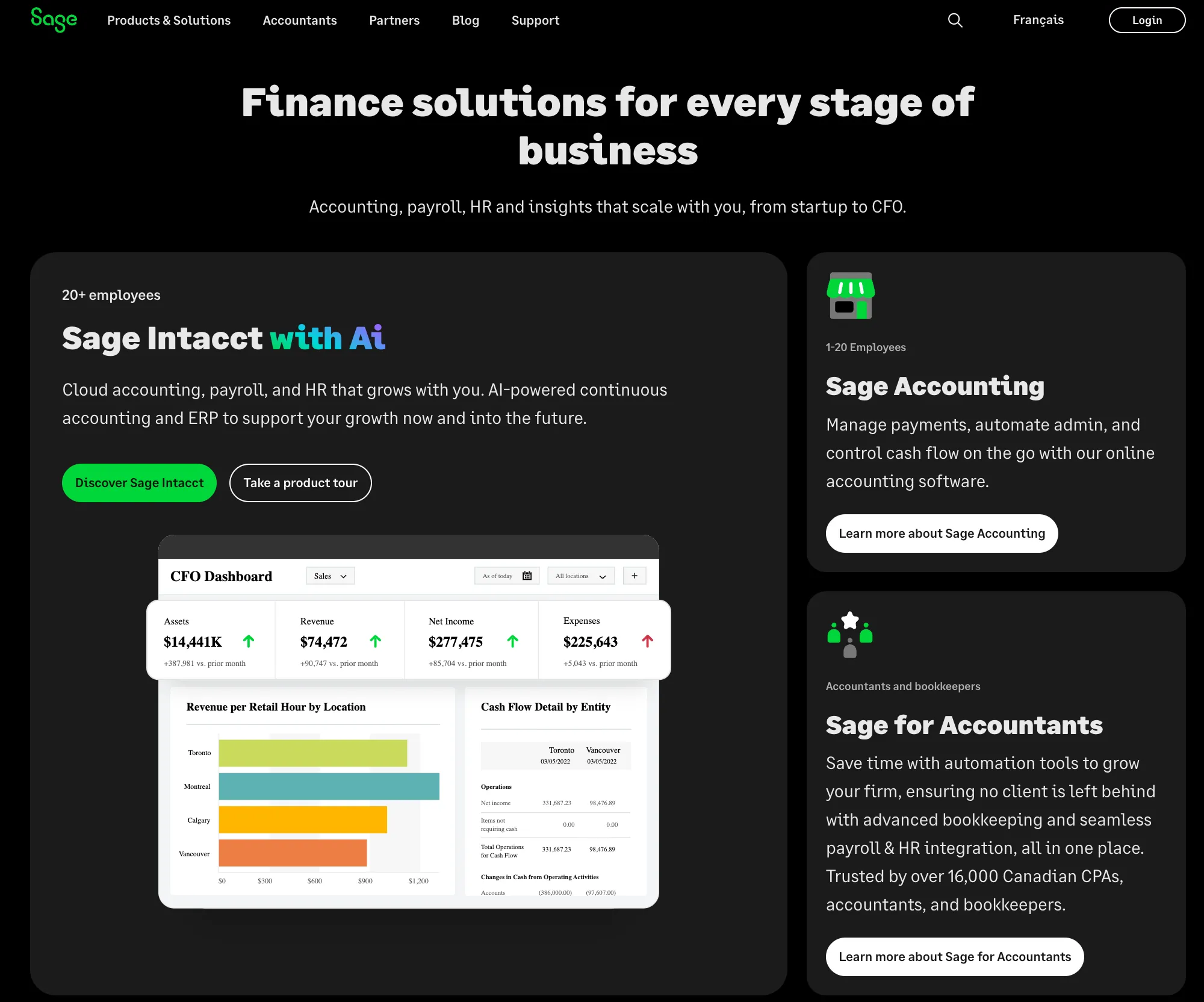

Sage Business Cloud stands as one of the premier cloud-based accounting and business management platforms for small to mid-sized businesses worldwide. Designed to cover accounting, finance, payroll, and HR, Sage’s fully integrated suite continues to evolve to meet the needs of a fast-changing work environment. As digital transformation becomes non-negotiable for SMBs, Sage Business Cloud positions itself at the intersection of automation, compliance, and scalability in 2026. It leads with AI-powered forecasting, real-time dashboards, automated reconciliation, and one-click reporting—features that elevate it from a traditional accounting tool to an intelligent business partner.

From Launch to 2026: Sage Business Cloud’s Journey

Launched in 2017 by Sage Group plc as a response to rising demand for scalable, cloud-first solutions, Sage Business Cloud began as a simplified platform unifying Sage’s accounting, payroll, and enterprise tools. It integrated key acquisitions like Intacct and AutoEntry, expanding its reach into mid-market and automation arenas. Key milestones include:

- 2017: Sage Business Cloud officially launches in the UK and U.S.

- 2019: Integration of Sage Intacct for advanced financial management.

- 2021: Introduction of AI-driven workflows and AutoEntry content capture.

- 2022: Global payroll integration with Sage HR and local tax engines.

- 2024: Launch of Smart Insights—predictive analytics for SMBs.

As of 2026, Sage Business Cloud’s core strategy centers around “Automated Clarity”—simplifying operations through AI while elevating visibility and control for business owners navigating complex markets.

Sage Business Cloud Key Features

Sage Business Cloud offers a robust feature set designed to evolve with your growing business. These include:

- Core Accounting: Real-time data sync, accrual/cash accounting, automated bank feeds

- Smart Reporting: Visual dashboards, forecasting tools, and customizable KPIs

- Payroll Management: Full-service payroll with automatic tax compliance

- Invoicing & Billing: Recurring invoices, bulk billing, automated reminders

- Inventory & Order Management: Track products across locations and manage suppliers easily

- AI Automations: AutoEntry for document capture, transaction categorization, and expense extraction

Workflow & UX

Sage Business Cloud’s UX delivers intuitive workflows without skimping on depth for finance teams. The dashboard is modular and customizable by user role or function. Navigation is guided with actionable prompts and prioritized data visuals. Tooltips, support embeds, and AI suggestions enhance ease-of-use, especially for users upgrading into the cloud from legacy systems. The mobile app reflects nearly full feature parity, enabling remote action for leaders and finance pros alike.

Sage Business Cloud Pricing Analysis & Value Metrics

As of July 2026, Sage Business Cloud pricing in the U.S. is structured in 4 main tiers:

| Plan | Monthly Price | Main Inclusions | Best For |

|---|---|---|---|

| Start | $14 | 1 user, basic invoicing & bank sync | Freelancers |

| Standard | $28 | 2 users, VAT tools, quotes, cash flow | Small teams |

| Plus | $42 | Multi-currency, project tracking, inventory | Growing SMBs |

| Payroll Add-on | From $35 | Up to 20 employees, e-filing included | U.S.-based teams |

Value Verdict: High ceiling for scale at entry-level pricing. Add-ons increase power for larger firms without forcing system migration.

Competitive Landscape

| Platform | Core Strength | Starting Price | Best For |

|---|---|---|---|

| Sage Business Cloud | Modular all-in-one with great entry pricing | $14/mo | Scalable SMBs |

| QuickBooks Online | Wider integrations, fast adoption | $25/mo | Freelancers & U.S. firms |

| Xero | Sleek UX, accountant-friendly | $15/mo | Global SMBs |

| FreshBooks | Simpler UI and time tracking | $19/mo | Solo consultants |

Use Cases

Sage Business Cloud shines in high-activity environments where accurate financial reporting is mission-critical. Leading use cases include:

- Service-based firms billing clients on recurring or milestone cycles

- SMBs scaling from 3 to 50+ employees with growing payroll complexities

- Retailers managing stock, invoicing, and tax compliance across regions

- Startups with part-time finance staff who need automation

Integrations

To support a connected ecosystem, Sage Business Cloud integrations include:

- CRM: Salesforce, HubSpot, Zoho

- Payments: Stripe, PayPal, Square

- E-commerce: Shopify, WooCommerce

- Payroll/HR: Sage HR, Gusto

- Productivity: Microsoft 365, Google Workspace, Trello

Pros & Cons

- Pros: Excellent modular scalability, AI automations save time, strong compliance tools, attractive pricing

- Cons: Learning curve for full suite, interface can get dense on smaller screens, some integrations gated to higher plans

Final Thoughts

Sage Business Cloud delivers a high-value toolkit for businesses looking to unify their accounting, payroll, and decision-making workflows. With extensive features, AI-driven clarity, and aggressive 2025 pricing, it particularly suits mid-sized enterprises, finance-forward teams, and service-based operations. For those prioritizing real-time insight and modular depth without enterprise bloat, Sage is an essential shortlist contender.

Pro Tip: Use Smart Reporting to connect revenue trends with forecast variance for sharper investment decisions.

Sage Business Cloud FAQ

Yes, the Start and Standard plans are ideal for solo finance managers, offering automation that reduces manual tasks and enables fast reporting.

Yes. The payroll module supports all 50 U.S. states, with auto-e-filing and compliance updates included in the monthly fee.

Absolutely. Sage Business Cloud integrations include both Shopify and Stripe, streamlining inventory and payment reconciliation.

Yes. The Plus plan includes full multi-currency capabilities with automatic exchange rate updates and reporting support.

Sage offers step-by-step migration tools and support to transition from QuickBooks, including import of contacts, GL, and prior-year data.