Gusto Overview & 2026 Industry Position

Gusto has positioned itself as a foundational HR tech solution for small to mid-sized businesses, combining payroll, benefits, hiring, and compliance into a single, intuitive platform. Founded with a mission to simplify payroll, it has evolved into a robust people platform utilized by over 300,000 businesses in the U.S. In 2026, Gusto remains highly relevant thanks to its proactive integration of compliance updates, streamlined onboarding tools, and adaptive automation powered by AI for tax filings and wage assessments. The rise of regulatory pressures and need for seamless digital HR tools in smaller organizations makes Gusto not just useful—but essential.

From Launch to 2026: Gusto’s Journey

Gusto began its journey in 2012 as ZenPayroll, targeting a gap in user-friendly payroll systems for SMBs. Upon rebranding to Gusto in 2015, it expanded significantly into HR and benefits management. Key growth milestones include:

- 2012: Founded as ZenPayroll in California

- 2015: Rebranded to Gusto; launched benefits and contractor payments

- 2019: Crossed 100,000 customers; introduced health insurance bundling

- 2021: Launched embedded payroll APIs for third-party platforms

- 2023: Debuted automated compliance alerts and document e-signing

- 2025: Introduces AI-informed tax optimization engine for SMBs

Gusto’s 2026 strategy? Deepen end-to-end HR automation and compliance tooling to meet the exploding complexity of workforce regulations while keeping ease of use at its core.

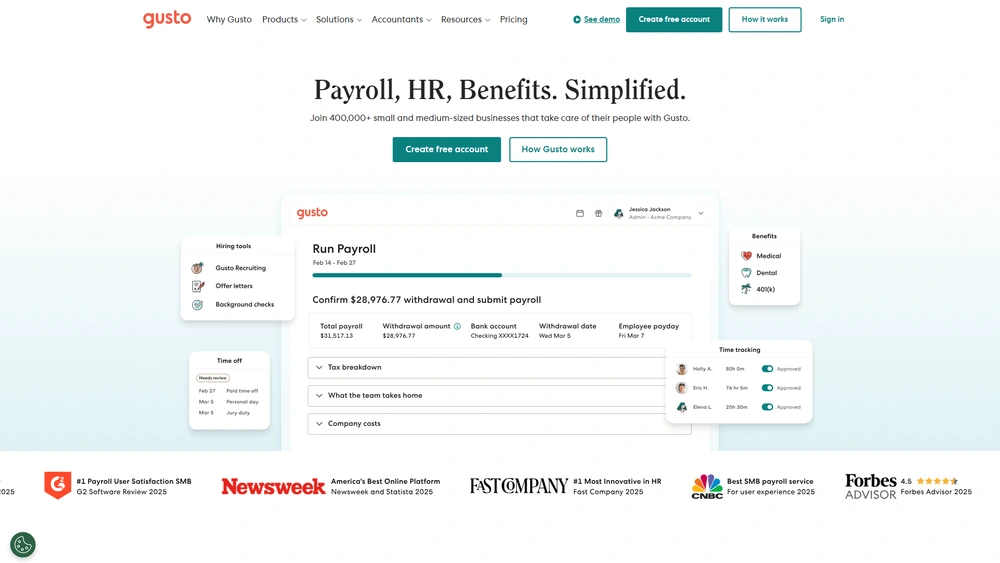

Gusto Key Features

Gusto’s platform is more than payroll—it’s a tightly integrated HR hub. Its strength lies in automating compliance-laden processes while preserving human-friendly UX. Core features include:

- Full-Service Payroll: Unlimited payroll runs, automated filings (federal, state, local), and garnishment support

- Benefits Administration: Medical, dental, vision plans; 401(k) and HSA management

- Hiring Tools: Offer letters, I-9 & W-4 e-signing, onboarding checklists

- Time Tracking + PTO: Track hours, request time off, sync with payroll

- Custom Roles & Permissions: Scalability for teams with layered access control

- AI Tax Engine (2025): Analyzes wage profiles for optimized deduction handling

Workflow & UX

Gusto’s platform stands out for its clean interface and contextual prompts that help both admins and employees know what to do next. Whether setting up direct deposits or configuring benefits, Gusto reduces errors by guiding users step-by-step.

- Onboarding Flow: Clear instructions and checklists, plus doc e-signing built-in

- Admin View: Smart alerts flag upcoming tax deadlines or unsigned forms

- Mobile Compatibility: Works smoothly across browser and mobile devices—no app required for employees

Pro Tip: Set up auto-reminders in Gusto’s admin portal for onboarding and tax filings—you’ll save hours each month verifying manual steps.

Gusto Pricing Analysis & Value Metrics

Gusto updated its pricing in July 2026. All plans include full-service payroll and employee self-service. Here’s a breakdown:

| Plan | Base Price/mo | Per Employee/mo | Includes |

|---|---|---|---|

| Simple | $49 | $6 | Basic payroll, employee profiles, PTO tracking |

| Plus | $79 | $12 | Onboarding, time tracking, team management tools |

| Premium | Custom | Custom | Dedicated support, compliance alerts, role permissions |

Value Summary: For companies under 25 employees, the Plus plan offers outsized value by blending automation tools with HR capabilities. Gusto also includes the first contractor payment in each month for free.

Competitive Landscape

| Brand | Best For | Highlight Feature | Starting Price |

|---|---|---|---|

| Gusto | SMBs (1–200 employees) | Unified payroll + benefits platform | $49/mo + $6/user |

| ADP RUN | Small–mid firms needing advanced HR compliance | Local compliance concierge | Custom pricing |

| QuickBooks Payroll | QuickBooks users | Integrated accounting + payroll | $45/mo + $5/user |

| Rippling | Tech startups and remote teams | Modular HR + IT | $8/user/mo (modules priced separately) |

Use Cases

Gusto shines in sectors where automation and simplicity reduce compliance risk. Common verticals:

- Professional Services: Law, marketing, consulting firms

- Hospitality & Retail: Staff-heavy environments needing time tracking and flexible pay

- Nonprofits: 501(c)3 tax settings and contractor handling

- Hybrid Teams: Remote-first orgs where onboarding and payroll timing need tight control

Integrations With Gusto

As of 2026, Gusto integrates with over 120 platforms, including:

- Accounting: Xero, QuickBooks, FreshBooks

- Time Tools: TSheets, Homebase, Deputy

- ATS/HR Platforms: Bamboo HR, JazzHR, Greenhouse

- eCommerce Platforms: Shopify, Square

These integrations enable seamless flow of worker data, hours, and payroll processing across tools and departments.

Pros & Cons

- Pros: Easy to use, strong compliance tools, broad integrations, robust employee onboarding

- Cons: Premium plan requires quote, limited international payroll, support wait times during peak tax season

Final Thoughts

Gusto remains a category leader for companies needing streamlined payroll and HR in one place. Its emphasis on usability, automation, and compliance puts it well ahead of legacy competitors. Ideal for U.S.-based SMBs growing under 250 employees, Gusto is a strong value—even at the Plus pricing tier.

Gusto FAQ

Yes, Gusto automatically calculates and files federal, state, and local payroll taxes included in every plan.

Yes. Gusto offers contractor-only plans where you pay only for the active contractors in a given month.

Yes, Gusto provides live support via chat and phone, with enhanced support available on Premium plans.

Yes. Gusto integrates natively with QuickBooks Online, syncing employee hours and payroll entries automatically.

Yes, Gusto supports payroll compliance across all 50 states and provides state-specific onboarding support.