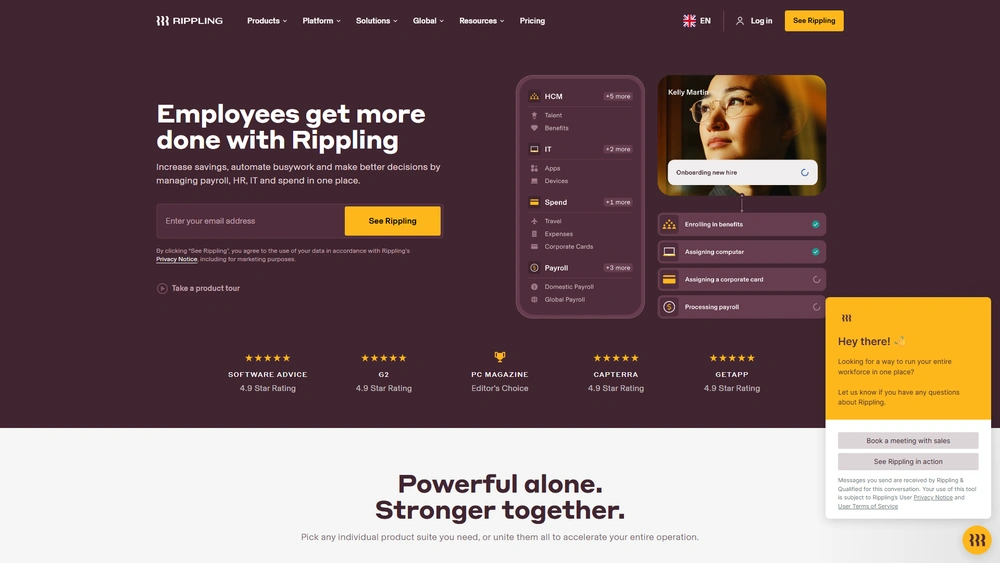

Rippling Overview & 2026 Industry Position

Rippling is a unified workforce management platform that has rapidly become a cornerstone for businesses seeking to consolidate HR, IT, and finance operations. Founded in 2016, the company has consistently challenged fragmented SaaS ecosystems by offering a single, integrated system that scales from startups to large enterprises. As of 2026, Rippling’s platform spans payroll, benefits, device management, expenses, and even corporate cards—all controlled from a centralized dashboard. With modular, policy-driven automation and robust reporting tools, Rippling is helping hundreds of thousands of companies navigate growth, compliance, and hybrid operations with remarkable efficiency.

From Launch to 2026: Rippling’s Journey

Rippling launched in 2016 under the leadership of Parker Conrad (former Zenefits CEO), aiming to fix the siloed nature of employee systems. With a core vision of unifying workforce data across departments, Rippling quickly evolved from a high-growth HR solution into a powerful enterprise operations hub. In 2018, the platform introduced IT device management; by 2020, it expanded payroll offerings globally. In 2022, Rippling debuted its Finance Cloud—bringing corporate cards, expense tracking, and procurement workflows into the fold. Fast-forward to 2024, the company raised a $500M Series F at a $12B valuation. Now in 2026, its strategy centers on automating workflows across departments with native AI, real-time compliance intelligence, and role-based data control, enabling agile operations for mid-market and enterprise clients.

Rippling Key Features

Rippling’s success hinges on its unification capabilities. Here are standout 2025 features business leaders should know:

- Global Payroll: U.S. and international payroll with localized taxation, reporting, and currency support.

- Benefits Administration: ACA compliance, open enrollment workflows, broker integrations, and automatic deductions.

- IT Management: Employee device provisioning, SSO, identity and access control synced to role changes.

- Rippling Finance Cloud: Corporate cards, approvals, expenses, and GL synching—fully integrated with employee data.

- Custom App Builder: Create apps and workflows using the Unified Workforce Graph API.

- Automated Policy Engine: Granular policy rules by department, geography, or role for system-wide automation.

Workflow & UX

One of Rippling’s most praised attributes is its intuitive user experience. Designed for HR, IT, and finance leaders—not just tech teams—its interface eliminates the tab fatigue common in multi-platform stacks. Everything is modular but nestable: admins can view the entire employee lifecycle by navigating through role cards and process steps without leaving context. Workflow automations are built via point-and-click policy logic, empowering users to create terminations, hardware retrieval, offboarding surveys, and finance revocation instantly without code.

Rippling Pricing Analysis & Value Metrics

As of July 2026, Rippling uses a modular per-employee pricing model by product stack:

| Product Stack | Starting Price | Include |

|---|---|---|

| Core HR Cloud | $8/user/mo | Onboarding, Time Off, Org Chart, Policies |

| Payroll (U.S.) | $6/module/user/mo | Tax filings, W-2/1099, automation |

| Benefits Admin | $6/module/user/mo | Broker integration, ACA, deductions |

| IT & Device Mgmt | $8–10/user/mo | Provisioning, SSO, app management |

| Finance Cloud | $12–14/user/mo | Cards, expenses, approvals, synching |

Fees depend on company size, modules, and country. Pricing includes support, compliance tools, and real-time usage dashboards. For companies with distributed teams or scaling needs, it offers exceptional ROI compared to managing separate platforms.

Competitive Landscape

Rippling competes across multiple categories, and its edge comes from system unification:

| Provider | Strength | Limitations |

|---|---|---|

| Gusto | Simplified payroll + basic HR for SMBs | No IT or finance tools |

| BambooHR | Robust HRIS for mid-size teams | No payroll or device management |

| Deel | Global hiring and compliance | Expensive; lacks IT/Finance workflows |

| Jumpcloud | Strong IT provisioning | No HR tools; limited automation |

Rippling’s main differentiator is its ability to blend HR, IT, Finance, and identity control into workflows visible across the company—for admins and employees.

Use Cases

Rippling is ideal for:

- Scaling startups and Series A–D companies needing consolidated IT/HR/finance tooling

- Global teams simplifying cross-border onboarding and compliance

- Hybrid organizations issuing devices, remote payroll, and benefits access in one place

- Finance Ops leaders needing seamless sync from expenses to ERP/accounting platforms

- People teams focused on automation, DEI policies, training, and lifecycle tracking

Rippling Integrations

Rippling supports hundreds of third-party integrations, with native syncing built into common tools including:

- Finance: QuickBooks, NetSuite, Xero, Expensify, Bill.com

- Productivity: Slack, Zoom, Notion, Google Workspace, Microsoft 365

- Recruiting: Greenhouse, Ashby, Rippling ATS (2025 Beta)

- Payments: Stripe, Square, Brex, Ramp

- CRM/Support: Salesforce, Zendesk, HubSpot

Pros & Cons

- Pros:

- All-in-one platform for HR, IT, Finance

- Fast onboarding with visual workflow builders

- Modular pricing based on stack usage

- Excellent compliance guardrails

- Modern UI and constant innovation

- Cons:

- Can be expensive for very small teams

- Learning curve for custom automation rules

- Global payroll limited to certain countries

Final Thoughts

If your organization is dealing with fragmented workflows between HR, IT, and Finance—or planning to scale globally—Rippling may be the most comprehensive automation platform available. It’s particularly well suited to mid-sized, VC-backed, and hybrid teams that need to scale headcount without scaling admin overhead. While initial setup requires some investment in time and training, the long-term ROI for automation and visibility is substantial. For companies ready to consolidate systems and gain more operational control, Rippling’s automations are tough to beat.

Rippling FAQ

Yes, Rippling works well for businesses with as few as five employees, although its full value is realized by teams managing multi-system workflows or preparing to scale.

Yes, Rippling supports global payroll in more than 30 countries, with compliance, currency, and taxation fully integrated to the central employee graph.

Absolutely. Rippling’s pricing is modular, so you only pay per user per product stack—ideal if you just need payroll, IT, or finance functions.

Most companies complete onboarding in 2–4 weeks depending on complexity. Existing HR/finance data imports can speed things up.

Yes, with 24/7 chat and support tiers plus dedicated implementation managers for larger teams.