Moss Overview & 2026 Industry Position

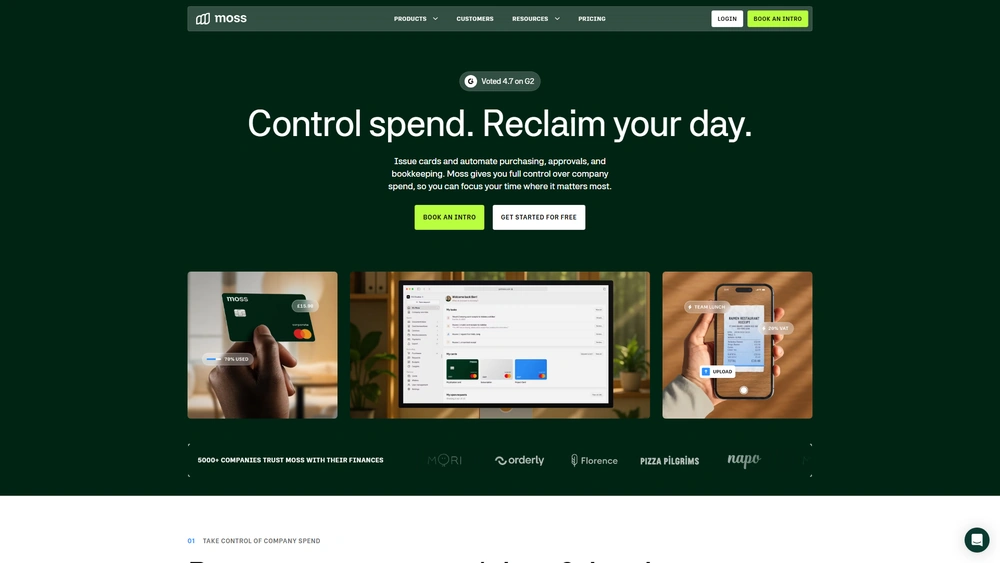

Moss has emerged as a dominant player in the modern finance automation ecosystem, especially for small to mid-sized businesses (SMBs) in Europe and increasingly across global markets. Since its inception, Moss has streamlined expense management with corporate cards, seamless invoice workflows, and advanced financial reporting. As of 2026, Moss not only boasts best-in-category experience for real-time spending control, but also bridges manual gaps in legacy ERP setups with automation, precision, and visibility.

Its position in the 2025 landscape is driven by heightened demand for agile finance stacks due to rising compliance pressure and economic volatility. Moss’s modular approach scales cost-efficiently and decentralizes financial operations with user-friendly controls—a must for today’s hybrid companies and finance-forward startups alike.

From Launch to 2026: Moss’s Journey

Founded in Berlin in 2019, Moss began as a smart company credit card solution geared toward startups seeking control over ad spend and team expenses. By 2021, invoice management and accounting integrations positioned Moss as a full-stack finance operations player. A 2022 Series B funding round enabled its rapid expansion into the UK and Benelux. In 2023, Moss added budget management and approval workflows, while 2024 brought real-time analytics and tax-compliant invoice matching. By mid-2025, Moss has embraced API-first architecture with embedded finance options tailored to growing companies. Its strategy hinges on finance automation for agility—compressing spend, pay, and reporting into one seamless process.

Moss Key Features

Moss is designed around an all-in-one finance operations hub. Here’s what it includes in 2026:

- Virtual & physical company cards: Assigned per employee or project with real-time budget rules.

- Invoice management: Receive, process, approve, and sync invoices directly to accounting.

- Reimbursements: Fast, compliant out-of-pocket expense reimbursements tied to policy.

- Advanced reporting: Real-time dashboards across spend, cost centers, and vendor payments.

- Accounting integrations: Seamless APIs with DATEV, Xero, QuickBooks, Microsoft Dynamics, and more.

- Custom approval workflows: Multi-step, rules-based processes without IT dependency.

- Audit-ready archiving: Tax-compliant invoice and receipt digitization (GoBD ready).

Workflow & UX

Moss’s interface prioritizes usability. Onboarding takes less than 30 minutes, with role-based configurations for employees, managers, and accountants. Accounting teams can automate GL entries post-payment, while employees enjoy app-based receipt uploads and real-time limit alerts. Drag-and-drop uploads, policy hints, and side-by-side approval previews reduce friction for invoice processing.

Admins can configure workflows via a no-code logic builder, mapping every spend request or invoice to multiple approvers by cost center, spend category, or amount threshold.

Pro Tip: Use Moss’s budget vs. actuals view to set dynamic limits that reset by project or time period.

Moss Pricing Analysis & Value Metrics

Moss pricing is flexible and tailored per business size with no public tier listing. Here are standard price structures based on July 2026 data:

| Plan | Monthly Base | Per Card/User | Key Inclusions |

|---|---|---|---|

| Startup | $99 | $3 | 5 cards, basic invoicing, DATEV export |

| Core | $179 | $4 | Unlimited cards, multi-step approvals, API access |

| Scale | Custom | Custom | ERP sync, multi-entity, priority support |

Value Perspective: Moss delivers high ROI for teams looking to move beyond corporate cards and into holistic finance automation. Pay-per-user scales predictably for companies under 250 employees.

Competitive Landscape

| Brand | Strength | Limitation | Best for |

|---|---|---|---|

| Moss | Unified cards + invoices | Europe-centric | SMBs scaling finance ops |

| Spendesk | Card-first simplicity | Limited invoice support | Small teams |

| Ramp | No-fee cards + AI spend | US-only | Fast-growing US startups |

| Pleo | Sleek UX | Approval workflows lacking | Creative & service firms |

Compared to other spend platforms, Moss automation stands out for its all-in-one structure—reducing vendor fatigue and syncing seamlessly across invoice and card workflows.

Use Cases

Moss serves a wide range of growing businesses, most often in these scenarios:

- Startup budget control: Founders use Moss to prevent burn across ad spend, SaaS tools, and travel with card limits synced to real-time forecasts.

- Mid-market financial visibility: Finance controllers introduce multi-level invoice approvals and API integrations into ERPs for compliance.

- Project-based organizations: Agencies and consultants track card usage by client or cost center for pass-through expense reconciliation.

Integrations & Ecosystem

Moss meets companies where they already work, syncing expense and invoice data into their financial stack. As of 2026, native integrations and ecosystem tools include:

- Accounting software: DATEV, Xero, QuickBooks, MS Dynamics, Lexware

- HR & payroll tools: Personio, Lano, and HRworks

- Communication & authentication: Slack, MS Teams, SSO/SAML

- APIs: For custom ERP or data warehouse connectors

These integrations streamline compliance, reduce reconciliation overhead, and support workflows from finance to operations and HR.

Pros & Cons

- Pros: All-in-one platform, fast UX, real-time controls, top-tier accounting APIs, Europe-wide support

- Cons: Limited to EMEA, custom pricing may deter SMBs, steep learning curve for administrators initially

Moss FAQ

Yes, as of 2026 Moss focuses on the EU and UK markets, but is gradually expanding its reach to global business users.

Yes, the Scale plan includes support for multi-entity configurations with individual budget rules and consolidated reporting.

Absolutely. Moss offers robust APIs and native syncs for real-time ERP integration, including accounting entries and approval logs.

Most teams are up and running within a week, with guided configuration sessions and plug-and-play accounting integrations.

Both options are supported—cards can be issued in the organization’s name or tied to individual employees depending on your policy.